The generally accepted definition of Inflation is the rate at which the general

level of prices for goods and services rises over time, leading to a decrease in the purchasing power of

money.

If inflation is 5%, something that costs $100 today will cost $105 a year from now

(generally speaking). In reality things increase by different amounts, inflation is measured using price

indices like the Consumer Price Index (CPI). The Consumer Price Index (CPI) is a

measure of the average change over time in the prices paid by consumers for a representative basket of

consumer goods and services. The CPI measures inflation as experienced by consumers in their day-to-day

living expenses.

A better way to think of inflation is the decreasing value of cash. Rather than

the cost of things going up, you should think of inflation as the value of cash going down.

Alan Greenspan (born March 6, 1926) is an American economist who served as the

chairman of the Federal Reserve from 1987 to 2006. During his tenure Federal policymakers privately

agreed on a 2% inflation target, but it wasn't publicly disclosed at Greenspan's insistence.

The 2% target is seen as a balance between the benefits of price stability and the risk of deflation.

Governments try to control inflation through the use of interest rate increases. Increasing

interest rates encourages saving and discourages spending.

The general opinion regarding

inflation is that a little inflation, especially if it's low, stable, and predictable, is a sign of

a healthy economy. This is because people want to see the value of their investments and assets

increase, and the value of their loans decrease. This only works in your favour if you have assets

and loans....

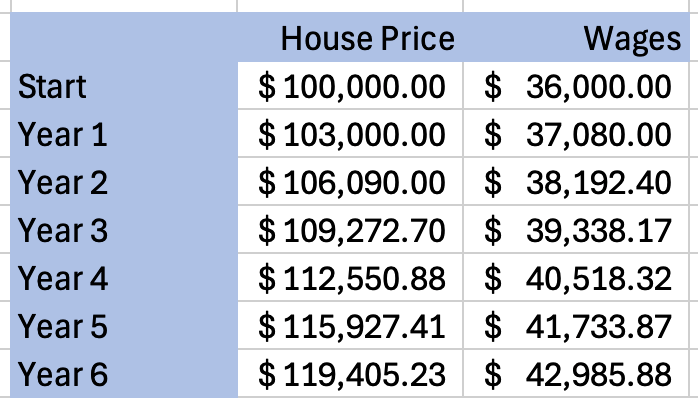

For this example, you borrow $100,000 from a bank at 5% fixed and 25 years and

bought a house. At the point you buy the house you earn $36,000 per year and your mortgage repayments

are $585 per month.

In this example I am going to apply the same rate of inflation to both the

value of the house and the wage increase.

This looks good, and shows the miracle of compound interest. My house has

increased in value by 20%, my wages have also increased by 20% and my mortgage repayments have stayed

the same.

Also from the lenders point of view he has done well too, he has received a 5% return

on his money, which is more than inflation by 2%.

This is an ideal situation everyone has

won.

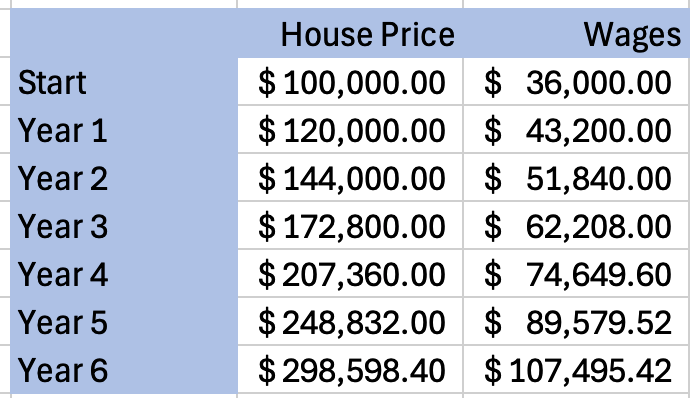

This is more interesting. My house has tripled in value, my wages have also tripled

and my mortgage repayments have stayed the same.

However the lender has lost money, as the rate

of inflation has outstripped the interest rate by 15%.

So now you have a situation where the

lender does not want to lend money again because he lost out. This is not good as if I can't borrow

money I can't buy the house.

It's only winning if we are all winning (winning by

different rates is fine 🙂)

Inflation is difficult to control. Inflation generally occurs when demand for goods

and/or services out strips supply. The wholesale prices of goods increase, which then causes an increase

in price of retail goods which then drives up the need for increased wages which also drives up the cost

for services. While everything is adjusting it's a painful period for a lot of people. If your

supermarket bill has increased significantly and your wages have not, that's not going to be a

pleasant experience.

Governments can exercise a limited level of control over inflation,

typically they can set interest rates of their central bank and/or print more money (quantitive easing).

This is why governments favour a low (2%) and controllable rate of inflation. Everyone wins and the

government looks as though they are managing the economy successfully.

On the 18th of April 1980, Rhodesia managed to swap a white racist government for a

black racist government and renamed itself Zimbabwe. A series of mistakes called the Economic Structural

Adjustment Programme (ESAP) led to a 45% decrease in food production, an 80% increase in unemployment

and an decrease in the life expectancy of the population. Demand for food, goods and services

outstripped supply and with the government unwilling to change anything, led to Hyperinflation.

The picture is of a one hundred trillion dollar note being swapped for two coconuts.

Disclaimer: We are not financial advisers. The information on this website is general in nature and does not take into account your individual circumstances. You should seek independent professional advice before making financial decisions.