We are not financial advisers. You should consider seeking independent legal,

financial, taxation or other advice to check how the website information relates to your unique

circumstances. We are not liable for any loss caused, whether due to negligence or otherwise arising

from the use of, or reliance on, the information provided directly or indirectly, by use of this

website.

The point of this page is to show you a useful way of thinking about your personal

finances. Everyone's situation is different and you will need to take that into account. The

information here represents nothing more than opinions.

When you're setting up your cash flow table, it helps to have each income

source as its own category. Under each income stream category, add a subcategory for the income itself,

and then additional subcategories for any expenses that come with earning that income.

For

example, if you have a regular 9-to-5 job, you should include things like commuting costs, tax return

fees, work clothes, tools or gear you need, or any job-related subscriptions. If you have an additional

income stream, such as, freelance work, an investment property, or even a hobby that brings in a bit of

money it’s a good idea to keep each one in its own category.

This way, you can easily see

whether each source is actually making money or costing you more than it’s worth.

One big bonus of organising your income this way is when it’s time to do your

taxes. You’ll already have a clear list of expenses for each income source, so it’s much easier to

figure out what might be tax-deductible. You can then compare that list to your receipts and

double-check things with your accountant. It’s a great way to make sure you're not missing out on

any tax deductions, and that you’re doing everything properly and legally.

After all, the

tax return is is your money that you have overpaid in tax. You should make sure you get

everything you are entitled to.

The late and great Kerry Packer famously said, “I don’t know

anybody that doesn’t minimise their tax … Of course I’m minimising my tax, and if anybody in this

country doesn’t minimise their tax they want their head read. As a government I can tell you you’re not

spending it that well that we should be donating extra”.

Click the link if you want to watch

the Kerry Packer tax speech.

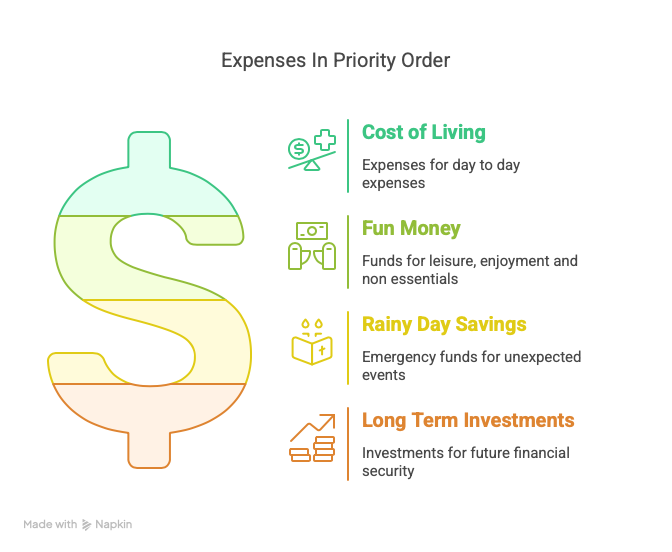

When thinking about spending money, I find it useful to think about which of the

following types of expenditure I am making. Being clear on the type often guides the decision of how

much I am willing to spend on something. Everyone's situation is different, the point of this is

not to provide financial advice but to get you thinking about your personal finances and how you can

leverage them to enhance your life.

If you come up with something better than the one below,

let me know and I will publish it.

The cost of living refers to the expenses required to maintain your standard of

living. This includes housing, utilities, food, transportation, healthcare and the interest

on loan repayments. Understanding your cost of living is vital as it forms

the foundation of your financial planning. It is important to track these expenses accurately to ensure

that you are not overspending and that you can meet your basic needs comfortably.

Your aim should

be to reduce your cost of living expenses as much as possible.

This is where the fun is, and everyone needs fun and laughter. Fun money is the

portion of your income that you allocate to enable you to do the things you enjoy. This can include

dining out, hobbies, vacations, and other activities that bring you joy. Allocating a specific amount

for fun money is important for maintaining a balanced lifestyle, as it allows you to enjoy life while

still being responsible with your finances.

Life is for living and not being miserable, It's

important to think about how you are spending this money, it's very easy to fritter it away on

extra coffees at work, another round at the bar, but maybe upgrading your car or going on holiday would

be more enjoyable? You can't do everything so think carefully about how you are spending in this

area.

Your aim should be to set a limit on how much fun money you spend and stick to it. You

will have lots of reasons to spend this money.

Rainy day savings are funds set aside for unexpected expenses or emergencies. This

could include medical emergencies, car repairs, or job loss. Financial experts recommend having at least

three to six months' worth of living expenses saved in an easily accessible account. This safety

net provides peace of mind and financial security, allowing you to navigate unforeseen circumstances

without falling into debt.

You can expect the unexpected, it will happen, you

just will not know what or when. It's important to keep cash aside for this, or a combination of

cash and available credit. Cash is better but may not be possible if your money is locked into long term

investments.

Your aim should be to have roughly between 3 and 6 months of living expenses in

readily available cash, read this if you want to

optimise the amount of rainy day savings.

An investment appreciates in value or generates an

income.

Long term investments are crucial for building wealth over time. This category

includes retirement accounts, stocks, bonds, and real estate including your own home.

Investing early and consistently can lead to significant growth due to inflation and the power of

compound interest.

It is important to educate yourself on various investment options and to

consider your risk tolerance and financial goals when making investment decisions. This is a fancy way

of saying stick to mainstream investments (S&P 500). Lots of people have lost a lot of money

listening to idiots with amazing ideas.

Unless you believe in fairies and that someone will come

to "save you" you should put enough money here to fund your retirement. When it's time

for you to retire, the government may not be as generous as you imagine.

If you are a sports

player earning great money, you should put your money here until this bucket is filled before giving it

the big "I am.....". Once you have you retirement money locked away, sure go for it, throw

money around like an idiot all you want.

The reason of thinking about the type of expense is to get you actively thinking

about your finances in terms of opportunities. If you take an opportunity now, you may be reducing or

increasing the

opportunities that are available to you in the future.

For example, if I want a car that I will

use for commuting and taking the family out and about, for $30,000 I could get a decent car, but for

$45,000 I could get the one I want. I would I think of that as $30,000 cost of living, $15,000 fun

money. Am I willing to reduce my fun money by $15,000 over the amount of time I plan on keeping the car?

Or would I prefer a few good holidays? It’s my money, my choices.

If I was going to finance

car, am I willing to increase my cost of living and rainy day fund accordingly due to the increased

repayments? Do I want to increase my rainy day fund first and then buy the car? This way I think about

the car and it’s benefits to myself and my family, and detriment to our finances rather than listening

to the sales person stroking my ego.

Ultimately to succeed at Personal Money Management,

you have to provide yourself with clear visibility of your cash flows and make the time to

make good decisions. No impluse purchases,

you're only going to help the sales person reduce the amount of time they have to spend on the sale.

Disclaimer: We are not financial advisers. The information on this website is general in nature and does not take into account your individual circumstances. You should seek independent professional advice before making financial decisions.