Looking for some help with your Personal Finances?

Having money definitely doesn't buy you happiness, but it does

remove a lot of things that cause unhappiness.

This website helps you manage your

personal finances more effectively, improving your ability to take advantage of the

opportunities life presents you with.

Interested in your finances? Want to understand where does your money go? Our website is for people who want to take charge of their finances and consequently improve their lives.

Stop wasting time and energy worrying about problems that may or may not exist, and spend time dealing with the problems that do exist.

Life will present you with many options. This website will enable you to see the financial impacts of those options.

Time is precious, using this website makes managing your personal finances a lot easier and a lot quicker.

Check out our blog section, here we provide you with information about basic financial concepts and how to apply them.

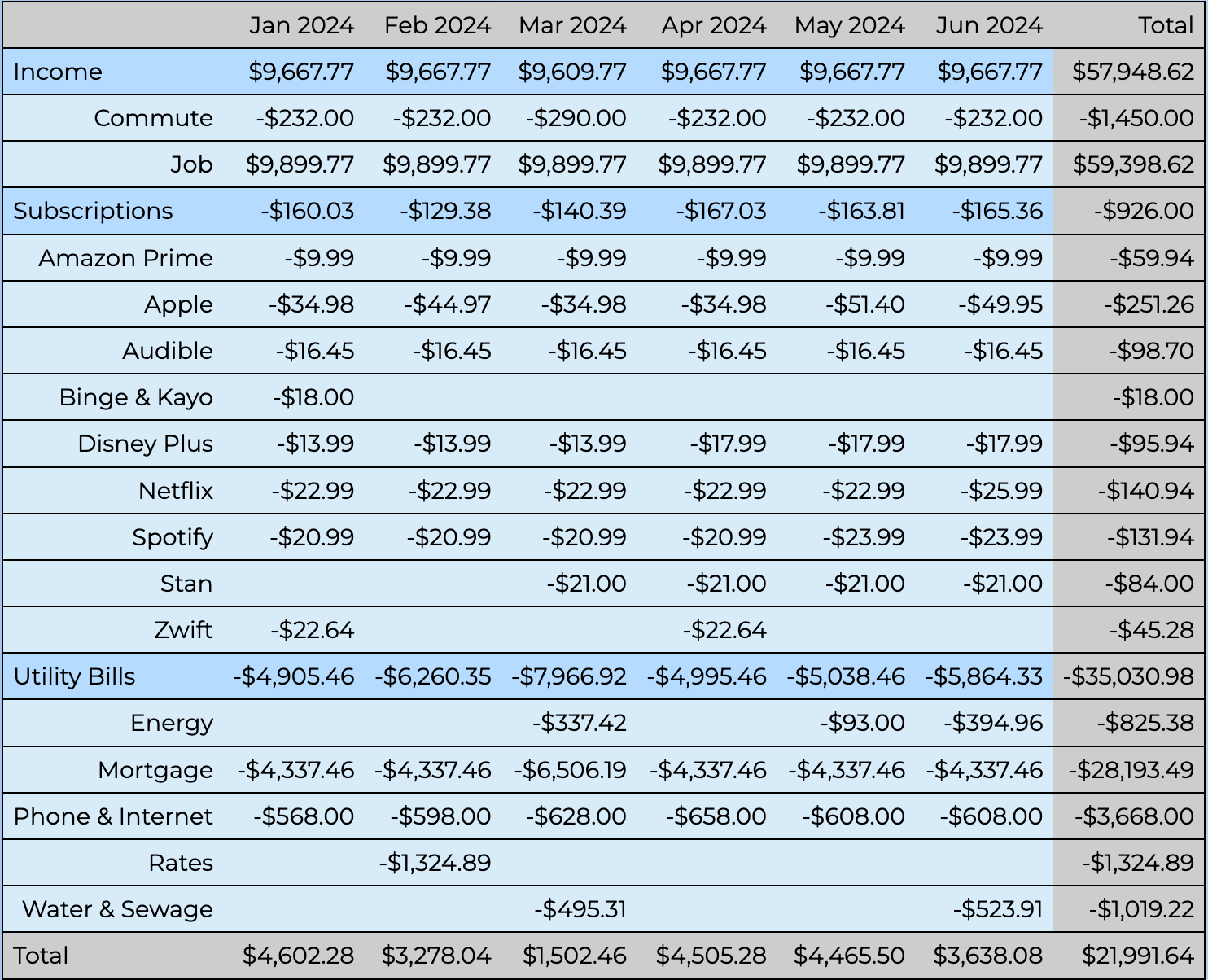

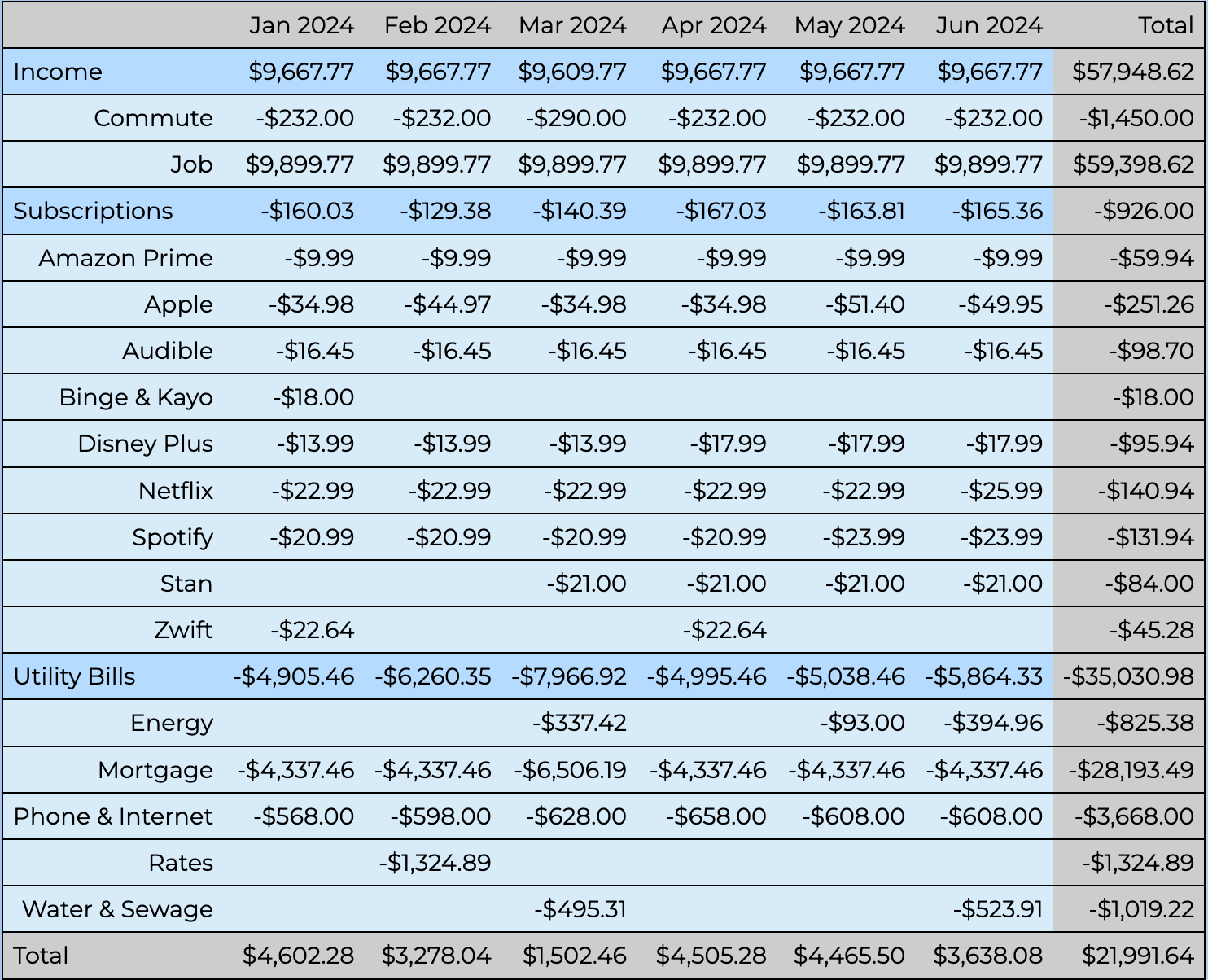

Build your cash-flow table and see exactly where your money is going. Patterns become obvious. Small leaks stand out.

Do you really need all those subscriptions? Are there expenses that no longer add value to your life?

Awareness is the first win, because you can’t improve what you can’t see.

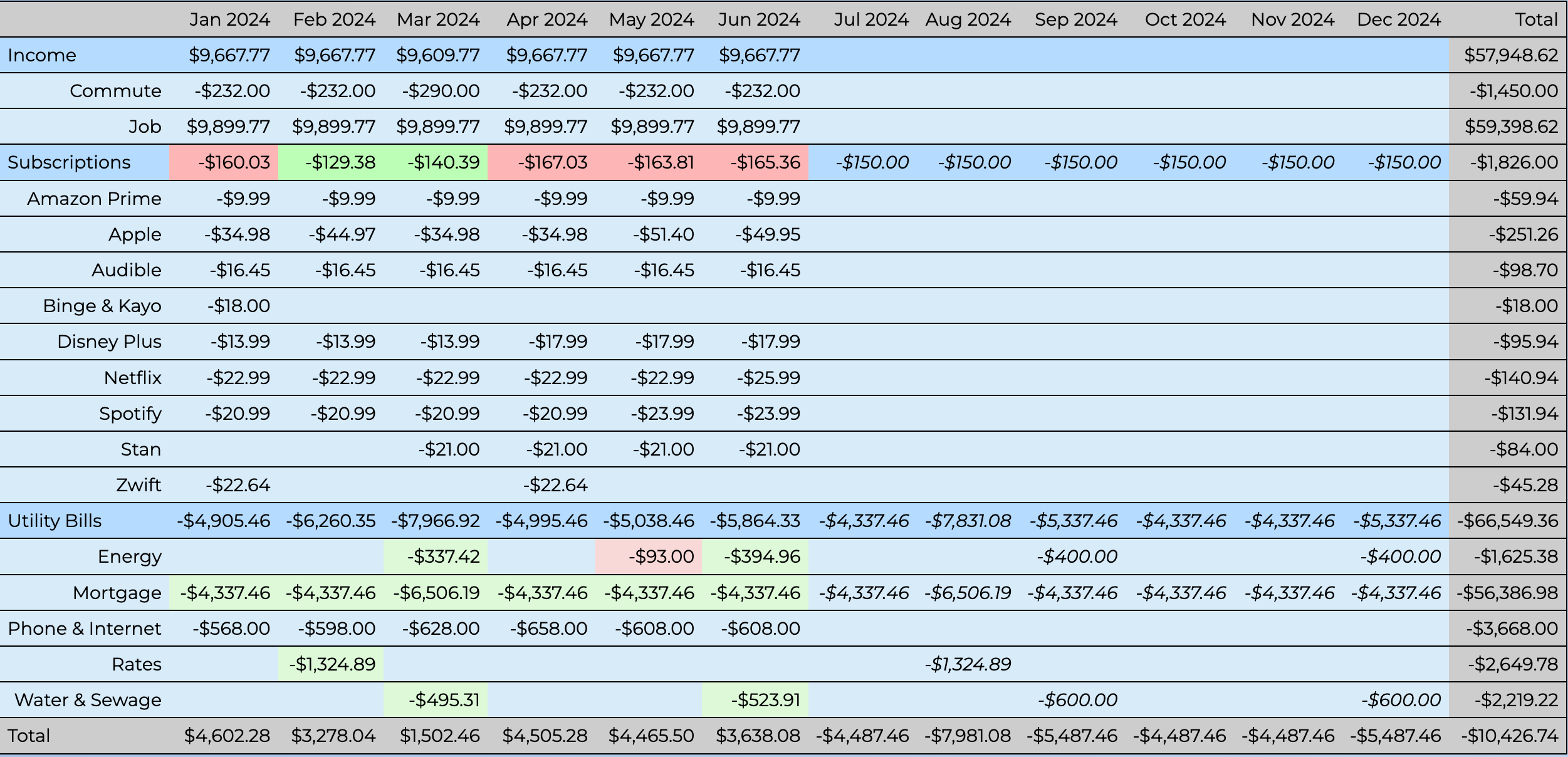

A clear cash-flow view turns information into insight. Instead of looking at

expenses in isolation, you start seeing how decisions connect, and how one change

can unlock multiple benefits.

Ask yourself better questions:

Add multiple cash-flow forecasts to explore your options before you commit.

See how different decisions shape your future. Compare paths. Test ideas.

Track your progress over time and adjust as life changes.

No guesswork. No surprises.

Because when you can see what’s ahead,

you’re free to choose the path that fits your life, not just your budget.

Managing your money gives you more room to say yes. Less stress. More

freedom. More space to spend your time, energy, and attention on the things that truly matter.

Life is found in the moments you choose to show up, to try, to move, to feel. Say yes more often.

Go places that stretch your comfort zone. Learn new skills, chase new passions, and throw

yourself into experiences that make you feel alive.

When your money is clear, those moments feel closer. More possible. Less out of reach. Money

isn’t the point, it’s the support that helps you live fully.

For the price of a cup of coffee a month and your willingness to take charge of your finances we can help you. Let’s build a good habit that lasts a lifetime.

Do you know what happens when you do nothing?

"Nothing".

Experience a transformative approach to managing your finances with

"Where Does My Money Go".

Free trial, no credit card required.